Why ‘I knew it all along’ can cost you in the stock market

Did you know that after a market crash, more than 80% of investors believe the warning signs were “obvious”?

Yet in the moment, those signs were buried in the noise.

Welcome to the hindsight effect: the sneaky cognitive bias that makes past events seem more predictable than they actually were.

For investors, this bias can be both comforting and costly. As platforms like Robinhood and Wealthfront make investing accessible to millions, understanding how the hindsight effect shapes decision-making is critical—not just for users but for the Product and Growth Managers building these tools.

The hindsight effect and investment psychology

The hindsight effect tricks our minds into thinking we "knew it all along." Once we see how a stock performed, we weave a story about why its success or failure was inevitable. This bias can:

Overinflate confidence: Investors might believe they’re better at predicting market trends than they are.

Downplay uncertainty: The randomness of the market—think black swan events like the COVID-19 pandemic—gets ignored in favor of a tidy narrative.

For Product and Growth Managers in the investing space, this psychological tendency presents both challenges and opportunities.

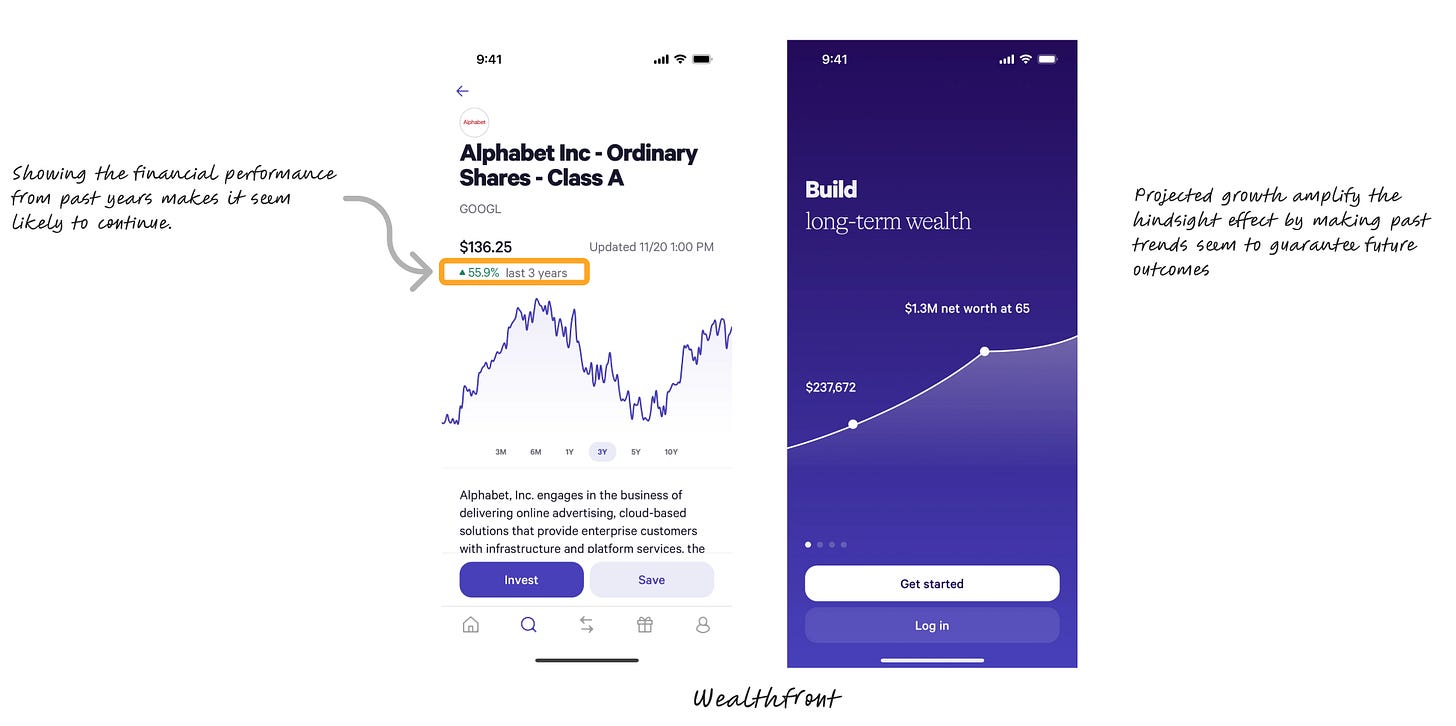

How investing apps trigger the hindsight effect

Investment platforms frequently present past performance data to help users analyze trends. But this very feature can inadvertently amplify the hindsight effect:

Performance summaries: Charts and graphs showing how a portfolio performed over time create a visual story that feels intuitive—too intuitive. Investors might see the growth of a stock and think, “I knew that was going to happen,” even if their actual reasoning at the time was much less clear.

Backtesting tools: Many apps allow users to simulate what would have happened if they had invested differently. While educational, these tools often highlight “obvious” winning strategies that are easier to see in hindsight.

Market insights and alaerts: Push notifications about market trends or stock movements can reinforce users’ belief in their predictive abilities, especially if they align with an investor's earlier hunches.

The danger of ignoring black swans

The most significant downside of the hindsight effect is how it causes investors to underestimate the impact of unpredictable, high-impact events—black swans.

What Are Black Swans? Black swans are rare, unforeseen events with massive consequences, like the 2008 financial crisis or the dot-com bubble burst.

Why Do They Matter? Because hindsight erases the chaos of these events, investors might fail to account for similar risks in the future, leaving portfolios exposed.

Actionable takeaways beyond investing:

Relying on past performance as a shortcut

It’s tempting to use past performance to predict future outcomes, but tools that highlight this need to tread carefully. Be upfront with users—past success doesn’t guarantee future results. Leaning too much on history can skew decisions, especially when outcomes are framed as “inevitable” in hindsight.

CEOs and hindsight bias

CEOs are classic victims of hindsight bias. When success hits, they often chalk it up to brilliant decision-making, conveniently forgetting the luck or external factors that played a role. It’s frustrating because this mindset can fuel overconfidence and downplay the unpredictability of the market.

A quick fix: document the facts

Jot down their rationale before making decisions. This small step can help them review choices later without the filter of hindsight. It’s like giving yourself a reality check—clearer insight into what worked, what didn’t, and why. 🛠✨

PS - If you found this post helpful, would you please consider restacking it and sharing it with your audience?

This spreads the word and keeps me writing content that will help you grow and learn.

Have you experienced the hindsight effect in your own decisions? Drop a comment below and share your thoughts—I’d love to hear your take!

After reading this I feel an urge to withdraw my lightyear account.